Do you have money left in this year’s budget for office equipment, computers (maybe some new Windows 10 devices), or software? Do you want to be able to write off your entire purchase? The Section 179 tax code lets you do just that!

What is Section 179?

We know that “simple” and “tax code” normally aren’t found in the same sentence, but Section 179 really is an easy way for your business to save money this year. According to Section179.org, “Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year. That means that if you buy (or lease) a piece of qualifying equipment, you can deduct the FULL PURCHASE PRICE from your gross income. It’s an incentive created by the U.S. government to encourage businesses to buy equipment and invest in themselves”.

How does it work?

Instead of writing off your business purchases piece by piece through depreciation, Section 179 allows you to write off your entire purchase of qualifying equipment for the current tax year (up to $1,000,000). This can drastically increase your small business’ purchasing power. Still not convinced? Use this calculator to estimate how much you could save.

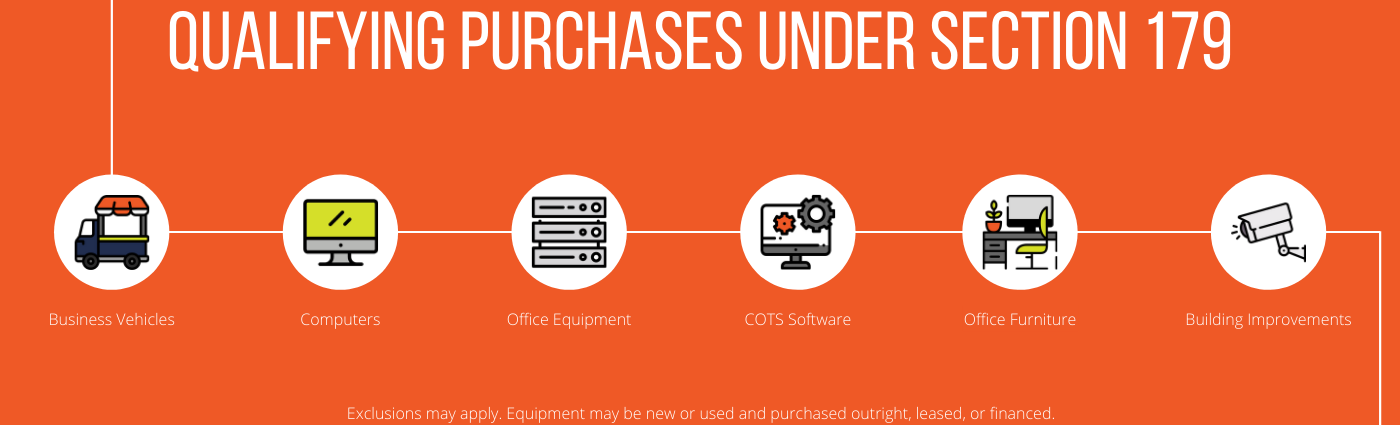

What is covered under Section 179?

Many ADKtechs products are eligible for this write off, including computers, software, and additional hardware like servers or printers. In order to qualify, you must purchase and complete installation between January-December of this year. A full list of qualifying merchandise can be found here.

How do I get started?

All you have to do is make and install your ADKtechs purchases, sit down with your tax pro to verify that they qualify for the deduction, and fill out the necessary tax form(s). Piece of cake!