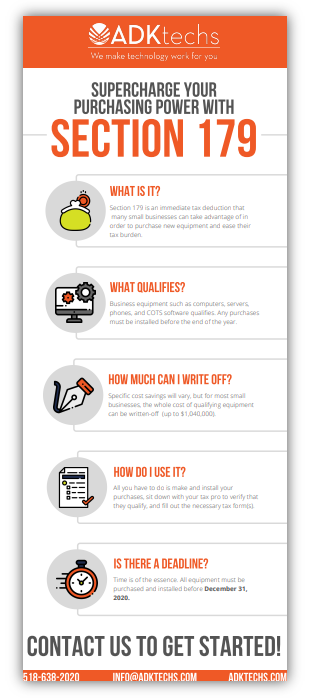

There’s no denying that 2020 has been a complicated and confusing year for small businesses. Now more than ever, it’s important to save however you can. Section 179 is an easy way for your business to make end of year purchases while still saving money. Never heard of Section 179? Here’s the 411.

What is Section 179?

Traditionally, when your business purchases equipment, it writes off a little bit a time through depreciation. One of the few government incentives applicable to small businesses, Section 179 is a tax code that allows businesses to write off the full purchase price of certain equipment and software for the current tax year, making it easier to innovate and grow. For most small businesses, the whole cost of equipment that can be written off in 2020 is $1,040,000. The total amount of equipment purchased must be less than $2,590,000.

What types of purchases are covered under Section 179?

Just about all business equipment you use qualifies, as long as it was purchased and installed between January 1, 2020 – December 31, 2020:

- Computers

- COTS Software

- Equipment (machines, etc.) purchased for business use

- Tangible personal property used in business

- Business vehicles

- Office furniture

- Office equipment

- Property attached to your building that is not a structural component of the building (printing press, large manufacturing tools and equipment)

- Partial business use (equipment that is purchased for business use and personal use: generally, your deduction will be based on the percentage of time you use the equipment for business purposes)

- Certain improvements to existing non-residential buildings (fire suppression, alarms and security systems, HVAC, and roofing)

Many ADKtechs products qualify including computer and software upgrades, laptops, servers, printers, security cameras, phone systems, and firewalls (just to name a few). Both new and used equipment qualify as long as used equipment is “new to you”. You can also take advantage of 100% bonus depreciation this year. Section 179 is typically taken first, followed by bonus depreciation

Do I qualify for Section 179 if I finance my purchases?

Yes! Even if you lease or finance your qualifying purchases, you’re eligible to write off the full price from your gross income. In fact, it may be your most profitable option. You can learn more about the perks of financing here.

How much can I save with Section 179?

Cost savings will vary but you can use the handy Section 179 Tax Deduction Calculator to get an estimate.

How do I get started?

An investment in your business is an investment in your future and your customers, especially when it comes to technology. As we mentioned earlier, many of our offerings qualify for the full write-off and we’re always ready to provide you with a quick quote. If you’ve already or plan on purchasing, financing, or leasing any qualifying equipment this year, you can simply elect to take the Section 179 Deduction when you file your 2020 tax return. All you have to do is keep records of the equipment you attained, where it’s from, and when it was installed to give to your tax pro. Easy!